Link

After a great upside move for four consecutive weeks, Nifty gave a halt to its rally last week. Nifty was unable to sustain near its all-time high levels and crashed vertically to the 17650 levels.

The Nifty future during this week ranged from 18360 to 17500, ending the week 3.50 percent loss.

IT and NBFC sector contributed the most for this fall, Nifty witnessed short built-up on OI ( open interest ) front in the week gone by.

Outperforming the benchmark index, Nifty Bank shed 2% during the last week.

Bank Nifty traded in the broader range of 38965 - 37275 and lost more than 700 points last week. The index also witnessed Long Unwinding on OI front in the week gone by.

Further diving into the Nifty upcoming weekly expiry CE writers showed aggression by building more position compared to PE writers. Nifty immediate support stands at the 17500 levels, where nearly 41L shares have been added, followed by 17000 levels with 57L shares.

On the higher side, an immediate resistance level is at 17900 where nearly 52L shares have been added followed by vital resistance at 18000 with addition of 94L shares.

Looking at the Bank Nifty upcoming weekly expiry data, on the upper side, immediate and vital resistance stands at 38000 (22 lakh shares). Whereas, on the downside, the immediate support level stands at 37500 (12 lakh shares), followed by 37000 (16 lakh shares).

India VIX, fear gauge, increased by 15% from 16.55 to 19.10 over the week. India VIX is trading near the lowest level of pre-covid crash. A cool off in the IV has given relaxation to market. Further, any downticks in India VIX can push the upwards momentum in Nifty.

Read More...

0 notes

Text

What are Option spreads and how to use them to get the best returns?

Options are one of the most popular instruments in the Indian capital market. Our volumes in Options in some of the indices are one of the largest in the world. Let us refresh our knowledge on what is this instrument.

Simply put, Options are contracts where the buyer gets a right to buy/sell a certain quantity (lot size) of a certain stock at a particular price (strike price) on a particular future date (expiry date) by paying a consideration called the premium. While the seller of an Option has an obligation to do the opposite and receive such premium. Here are the stocks where options can be traded, the lot size and the expiry date are decided by the exchange.

Read More...

0 notes

Photo

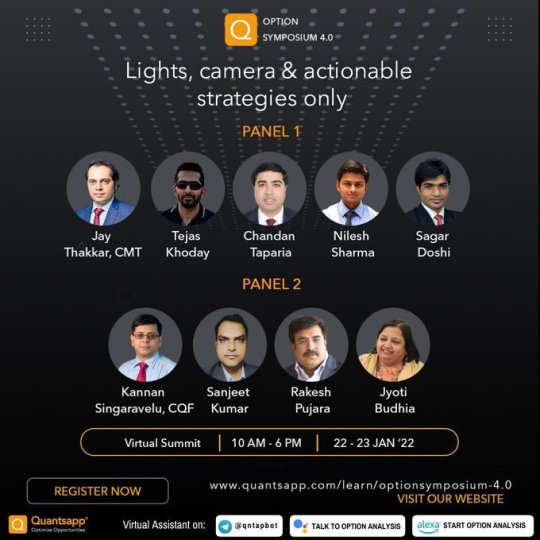

Option Symposium 4.0 Quantsapp's annual Conference on Options Trading which aims to bring together the country's top Option Fund Managers, Derivative Analysts, Option Trainers & Individual Option Traders to join hands & enlighten option enthusiasts with various Practical Options Trading styles and their winning strategies.

0 notes

Link

Nifty has been approaching new all-time highs and with indices possibly ending their consolidation there may be many fast-moving opportunities in either direction for many stocks. The fast moves can be well leveraged without even taking an un-limited risk using Backspreads. Let us understand how to create backspreads and their pros and cons.

What are Backspreads?

Backspreads are strategies where one typically sells an ATM strike option and buys 2 lots of OTM strike options. If the view is bullish the same can be created with calls and for a bearish view puts can be used. Backspreads can also be created by selling ITM options and buying OTM options.

The ratio of selling to buying could be any number but 1:2 is generally preferred. This strategy can have net premium outflow or in some cases may not have an outflow at all. Though, one should avoid buying too far OTM options as the probability of profit will also diminish in reality.

Risk

A good thing about backspreads is that, since we are buying extra options ,the strategy has a limited risk profile. But, the upside is unlimited. In terms of Option Greeks, there are two risk factors: Delta & Theta .

Read More...

0 notes

Text

Time to hedge your positions, deploy Bear Put Spread on Nifty this week

The Nifty failed to hold onto 12,000 and closed last week flat but above 11,900 levels. The Bank Nifty had a better last week and ended over a percent higher.

Open interest (OI) activity for both indices was on the positive side, though with more longs than shorts. The Bank Nifty added over 70 percent OI last week.

Stock futures were not so fortunate, with 70 out of the 148 participating stocks adding shorts. The stocks that did see long interest were also from the pack that has seen short covering recently.

Most stocks reaching the list of longs last week were the result of bargain hunting attempts in beaten-down names.

Sentimentally, Open Interest Put Call Ratio (OIPCR) held on last week. But the weakness on November 8 pushed the OIPCR down to 1.26, down around 20 bps week-on-week. On the other hand, India VIX was awfully quiet for the week-ended November 8, hovering below 16.

Among individual Nifty strikes, 12,000 remains the undivided consensus for the upside hurdle. What’s scarier though is consensus despite the proximity to that level. On the lower side, congestion remains firm in the 11,700-11,500 zone.

Read More...

0 notes

Link

Every few months there comes a time when there is lack confidence on direction but lot more conviction on volatility. In such times generally we do go on a backfoot and avoid to trade. However, one such strategy that comes in handy while trading such view is Back Ratio Spread

A situation, where we have firm view on volatility that there is a very bright chance of movement, the choice of Bull or Bear for a Biased Volatility can be made easily with choice of instrument Call or Put.

Back Ratio Spread is a strategy where for Bullish Biased Volatility, we need to Sell a Call of the strike closest to the current underlying level and Buy not 1 but 2 lots of a higher strike Call. If we wish to trade Bearish Biased Volatility view, we choose Puts. Here, we need to sell a Put of the strike closest to the current underlying level and buy 2 lots of a lower strike Put.

What this ends up doing at the beginning is it reduces the premium outflow considering the Higher calls/Lower Puts cost lower then the Call/Put of strike close to current level.

Read More...

0 notes

Link

Every quarter we are presented with opportunities to trade due to the announcement of corporate results . These results create movements in the stock prices. As we all know more movement means more opportunities to trade.

Read More...

0 notes

Link

The recent rise amid the unfolding of the event is peculiar but not unusual. The positive outcome would generally add fuel to any increment and often times exaggerate the rise. While trading the positive move in the making is profitable and easy, taking fresh trades on the long side after the rise at the same time could become a courageous move.

Risk lies in either a digestive consolidation or a sudden market realization of the exaggeration followed by a strong pullback.

Read More @ https://www.quantsapp.com/learn/articles/scared-of-buying-after-a-rise-conquer-the-fear-by-staggered-option-strategies-shubham-agarwal-155

0 notes

Link

Implied Volatility is the volatility figure that the Option Premium trading in the market indicates when we feed in the rest of the 4 factors. Now, why is this important? Because the implied volatility figure indicates the market assessment of volatility and could be higher or lower than the historical volatility . While that is one dimension that can be statistically evaluated and modelled for inferences, the very behaviour of the Implied Volatility compared to the behaviour of the underlying can help get an insight into an upcoming storm.

Let us understand what anomalies we are looking for, to alert ourselves and what do they indicate?

Quite naturally, building something is time-consuming and slow (less volatile in our context), at the same time breaking things (especially equities) is rather fast. So, quite naturally we would often times see the Implied Volatility rising when the underlying is falling and vice-versa.

While this negative correlation between the Implied Volatility and the underlying is well established, it does have some exceptions. In case there is going to be a known event, let us just say results of a company or a policy decision reflecting the rise in implied volatility of some index.

Read more @ https://www.quantsapp.com/learn/articles/track-implied-volatility-a-handy-risk-indicator-and-avoid-accidents-shubham-agarwal-153

0 notes

Link

So, with direction out of the way, we still need to have something to bet on for us to come out as a winner and get rewarded. That something is the speed of move, in whichever direction it may be. In other words, the trade will be on the volatility instead of direction.

The two set of strategies now are simple to define. One set would be in favor of Volatility going up and one would be in favor of Volatility going down. Let us look at each one and try and find the “When” and “How” of these strategies.

Expected Rise in Volatility : When: This is a rather simple situation. Most of us would know when an underlying is at a pivot point. Without an event in sight, if one senses the underlying stock or index that has been in a lull and trying to break away from a pivotal level, that’s when one would be expecting rise in volatility.

How: This non directional trade is simple. We do not know where the underlying will go, will it pivot upwards or downwards but, we do expect a big move as the pivotal level is distanced a tad bit. So, we will go ahead and buy volatility by Buying both Call and Put of strike close to CMP.

Read more @ https://www.quantsapp.com/learn/articles/Why-non-directional-options-strategies-are-a-must-have-in-trading-portfolio-165

0 notes

Link

Let us understand what Butterfly strategy is first. A Butterfly strategy is where we sell 2 Calls or 2 Puts depending upon the upward or downward move expectation and Buy a Lower strike Call/Put and a higher strike Call/Put at equal distance. The Maximum profit would be with expiry at the center strike. Maximum profit would be the difference between Buy & Sell strikes minus the premium paid at the time of initiation.

This is perfect for a consolidating market, however, there is still a possibility of the upper or lower bound being taken out in the upcoming gyration. If that happens the Butterfly strategy would still yield a loss beyond the bought strikes.

Now let us understand the OTM part of it. OTM is nothing but when the center strike of which 2 options are sold is chosen to be OTM. OTM means higher Call or Lower Put. Try to choose this strike that is closest to the targeted value.

0 notes

Link

In my experience of being in the Options Trades for almost 2 decades now, I have seen many traders get out of trading this scientific instrument too soon, sometimes even within just a few trades. The word scientific may have the reasons for these few early departures. The nature of this instrument is such that one must look at multiple factors while trading them.

0 notes

Link

Options being priced at a fraction of the price of the underlying equity or index to which it belongs does attract a lot of attention from traders. Traders look at options as an economical way to trading the same equity or index.

0 notes

Link

Nifty has been consolidating in a range of 350 points since the last month and a half, with volatility slipping to new lows. A formation like this is generally followed by a breakout on either side. Here's how you can go about it.

The Forecast

Traditionally, traders have spent a lot of effort in deciding the direction of the market to make returns from breakouts. But with options, you do not need to figure out the direction, as just the expectation of a breakout on either side can be used to build a strategy. This can be done in options, using the volatility strategies.

Volatility Strategies

The volatility long option strategy family has many permutations and combinations. The simplest ones could be buying a Straddle or Strangle, but in most of these strategies, the theta decay is large and if you hold the strategies for more than 3-4 days, the forecasting power can get diluted with the trade-off of theta decay.

If you expect volatility to evolve with some more time, strategies like Short Butterflies and Short Condors can be a better option. All volatility long strategies are limited risk, as net option trade is buying option and in almost all cases, you pay some theta decay.

0 notes

Text

Bull Call Spread Option Strategy

What is Bull Call Spread Option Strategy?

Bull Call Spread is a net debit strategy with limited risk to limited reward. Bull Call Spread is a moderate bullish strategy that is executed by buying a call and selling a higher strike call to fund it and reduce the execution cost, it should not be executed when we have extreme bullish biases as profit is capped on the upside.

0 notes

Link

Options Greeks are turned away most of the time due to their heavy mathematical calculations and not being so simple to comprehend. So, instead of trying to derive values of such Options Greeks, let us try to just define them and at least get the applied utilities of them in our everyday option trading.

If we were to calculate each and every Options Greek of our position it would not be possible unless one is a mathematician. However, there is an easy way out as there are numerous platforms available nowadays that help us with Options Greeks of our total options positions.

Why look at Options Greeks? Well, because they give an insight on the options positions. It would throw light on the fact that in an attempt to contain the unfavorable underlying price risk if we have taken any other risk that could ruin our profitability despite our view going right. Visit us @ https://www.quantsapp.com/learn/articles/ for more articles.

0 notes

Link

In the current market scenario many traders resort to Covered Call Strategies . Here, one would buy a Future and Sell a Call of Strike close to the price objective. Since one is not expecting a big move in a rather nervous market, giving up any profits above the Sold Call strike sounds alright for a cushion of the premium received against the option sold.

Assuming we are running this trade with a lower price level, stop loss in the underlying and if we do not hit that for a few days. There is a possibility that a bit of nervousness and passage of time could pull out 70-80 percent value of the Option sold.

0 notes